NECA Worries Over New Taxes In Finance Bill

The Nigeria Employers’ Consultative Association (NECA) has expressed concerns over new tax burdens in the finance bill recently passed by the National Assembly.

The president had while signing the 2023 Appropriation Bill into Law this week, stopped assent to the bill pending when all grey areas are addressed.

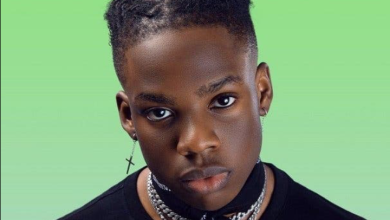

While speaking in Lagos, the Director-General of NECA, Mr. Adewale-Smatt Oyerinde, who commended President Buhari, noted that while organized businesses are still faced with burdensome numbers of taxes, the Finance Bill seeks to add additional burden on businesses.

He noted that it is worrisome that the Tertiary Education Tax (TET) was increased from 2.5% to 3.0% without “legacy regard for current economic situation faced by businesses”.

Sharing insight on what he termed a “legacy of taxes and levies”, the Director-General noted that organized businesses are currently burdened with over 50 different taxes, levies and fees.

“Increasing CIT rate for a gas-flaring company from the standard 30% to 50% is also worrisome, considering the fact these companies are already covered in the Petroleum Industry Act. This could be a recipe for further divestment. Also, the imposition of Excise Duty at rates to be specified via Presidential Order on all services including telecommunication services, is too broad and vague. This could be subject to abuse and further strangulation of the business community,” he said.

Oyerinde stated that it was absurd that the National Assembly would consider and pass the Finance Bill in an unusual manner.